Irs 2024 Child Tax Credit Update Portal – If you have a child — even one that was born in 2023 — you may be eligible for the child tax credit. If you qualify, the credit could reduce how much you owe on your taxes. As of right now, only a . Someone making $150,000 a year, for example, and receiving a child tax credit wouldn’t see a boost on a 2023 return. This group could receive a bit more money, though, when they file their 2024 and .. .

Irs 2024 Child Tax Credit Update Portal

Source : www.taxoutreach.org

Change Address on Child Tax Credit Update Portal Taxing Subjects

Source : www.drakesoftware.com

How to use the IRS Child Tax Credit Update Portal (CTC UP) – Get

Source : www.taxoutreach.org

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

How to use the IRS Child Tax Credit Update Portal (CTC UP) – Get

Source : www.taxoutreach.org

CHILD TAX CREDIT ONLINE FILING PORTAL IS OPEN AGAIN: | NSTP

Source : nstp.org

How to use the IRS Child Tax Credit Update Portal (CTC UP) – Get

Source : www.taxoutreach.org

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

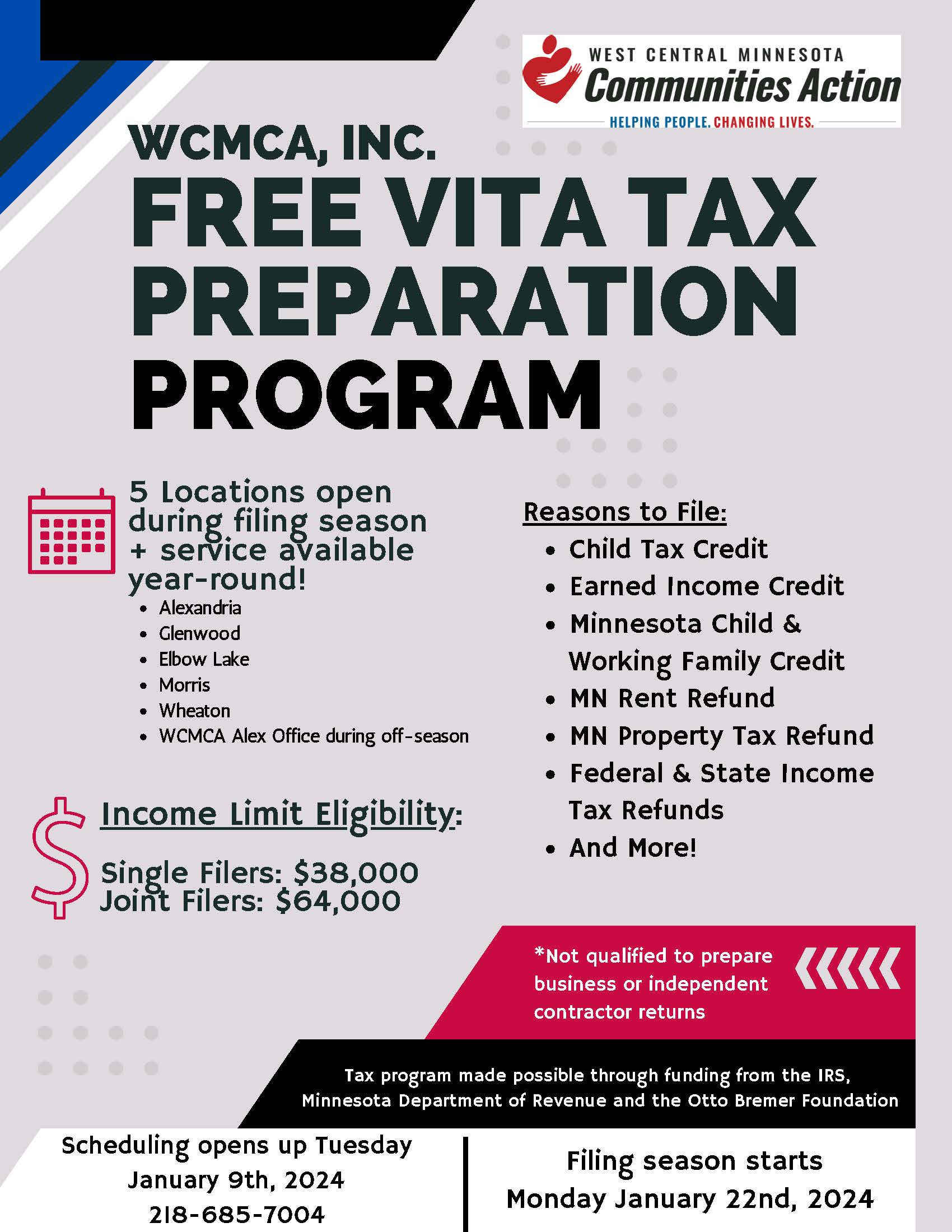

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

How to use the IRS Child Tax Credit Update Portal (CTC UP) – Get

Source : www.taxoutreach.org

Irs 2024 Child Tax Credit Update Portal How to use the IRS Child Tax Credit Update Portal (CTC UP) – Get : Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. . The IRS notes that most taxpayers who filed online will receive their refund within 21 calendar days of filing. If filed by mail, it will take about four to six weeks. You can call the automated .